Veja também

23.12.2025 01:12 AM

23.12.2025 01:12 AMWhy focus only on the negatives? Let's talk about the positives! Following the European Central Bank's stance, the banks of Italy and France raised their GDP forecasts. Every member of the Governing Council is indicating a stronger eurozone economy than expected and noting that the ECB is in a comfortable position. The ECB has managed to tame inflation, which instills hope for a recovery in the upward trend in EUR/USD.

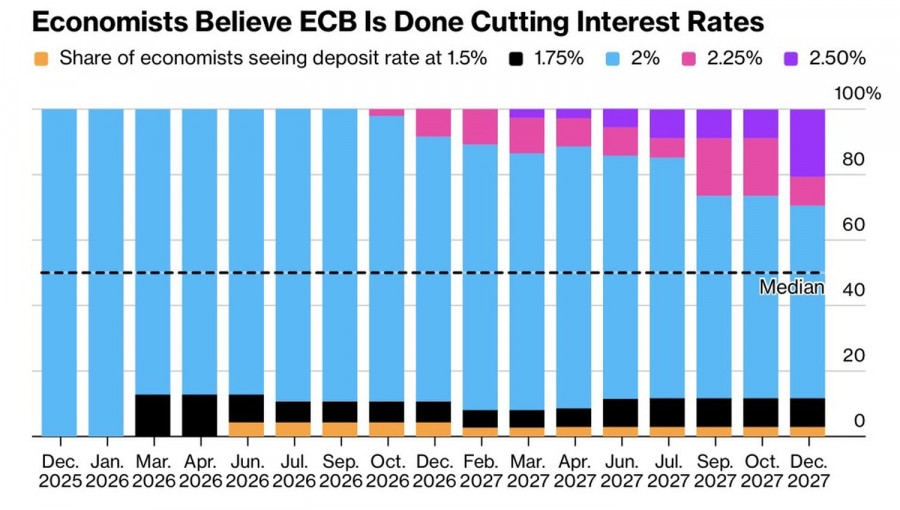

A Bloomberg insider report after the December ECB meeting noted that informed sources suggest the end of the monetary easing cycle. Unless there are any shocks, rates will remain unchanged. According to Governing Council member Gediminas Simkus, many view a 2% deposit rate as a neutral level—not stimulating but not holding back the economy either.

His colleague Pierre Wunsch pointed out that a strong euro and flows of cheap goods from China are having less impact on European inflation than previously thought. The monetary policy is in good shape. In fact, most Bloomberg experts believe that the monetary expansion cycle is over.

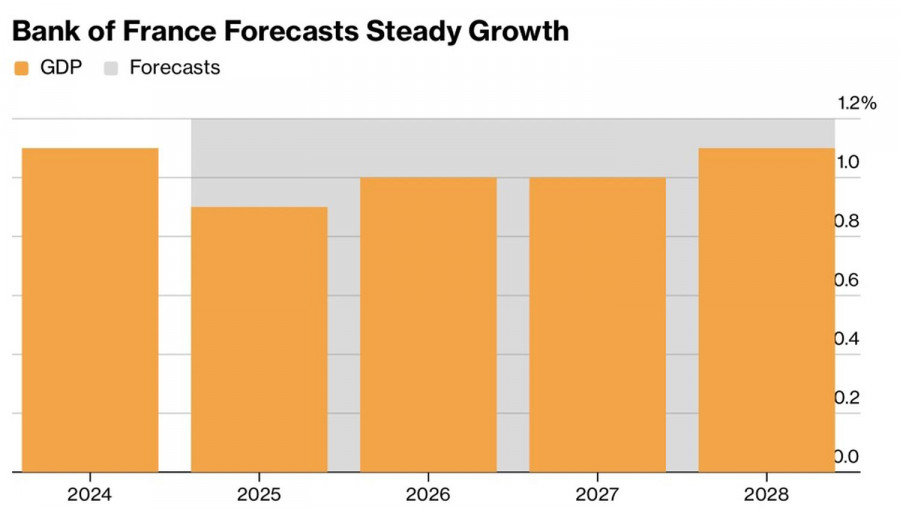

The Bank of Italy raised its GDP forecast for 2027 from 0.7% to 0.8%, citing that the economy is successfully resisting all prevailing headwinds. The Bank of France went even further, raising its GDP estimates not only for 2026 from 0.9% to 1.0%, but also for the current year from 0.7% to 0.9%. The economy shows resilience to both political turbulence and fiscal uncertainty.

Thus, the euro looks to the future with optimism. Bulls in the EUR/USD market are betting on a stronger-than-expected economy in the currency bloc and the ECB's intention to end the cycle of monetary easing, possibly even transitioning to rate hikes.

The Federal Reserve is far behind the ECB in this regard. Inflation is not anchored, and GDP is growing rapidly, with expectations of a 3.2% expansion in the third quarter. The labor market is cooling. It is no surprise that some FOMC officials are discussing a prolonged hold on the federal funds rate at 3.75%, while others are ready to reduce it, citing that consumer prices tied to tariffs will slow in 2026 and that rising unemployment could become uncontrollable.

A pause in the Fed's monetary easing cycle plays into the U.S. dollar's favor. However, the divergence in monetary policy will manifest sooner or later. So why wait? Wouldn't it be easier to start buying EUR/USD at the market rate?

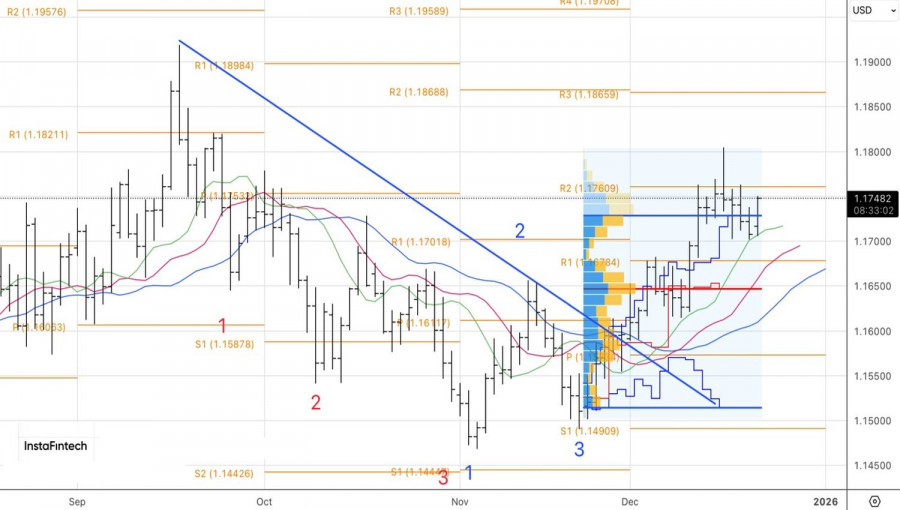

Technically, on the daily chart of the primary currency pair, the bounce from the dynamic support in the form of the moving average has allowed the bulls to regain control. A breakout of resistance at 1.176 will provide a foundation for forming long positions in EUR/USD.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.