See also

11.02.2026 12:32 AM

11.02.2026 12:32 AMOn Tuesday, the EUR/GBP exchange rate once again surpassed the 50-day SMA. The pair receives moderate support from the euro, although the single currency's overall momentum remains muted amid fresh signals from the European Central Bank.

In the Eurozone, the euro faces a lack of clear drivers following comments from ECB President Christine Lagarde. She expressed confidence in a stable return of inflation to the 2% target in the medium term, which aligns with her statements from last week regarding monetary policy. This rhetoric reinforces expectations of a prolonged period of unchanged rates, curbing the euro's additional growth potential.

However, the euro gains support from statements by ECB Vice President Luis de Guindos. He confirmed the adequacy of current rates while emphasizing the need to maintain neutrality in assessing future steps. De Guindos also noted that the recent strengthening of the euro is not dramatic and that inflationary trends align with the central bank's forecasts.

Meanwhile, the British pound is under pressure due to escalating political uncertainty in the UK. Prime Minister Keir Starmer is facing increasingly vocal calls for his resignation following the appointment of Peter Mandelson as ambassador to the US, which has provoked criticism regarding Mandelson's controversial past. Despite the pressure, Starmer has rejected the idea of stepping down, emphasizing his determination to continue with the support of several high-ranking cabinet members.

Investors are exercising caution, fearing that a leadership change could undermine fiscal discipline and provoke an increase in government borrowing. The focus of the British market is on the upcoming GDP, industrial production, and manufacturing data scheduled for release on Thursday, which could further influence the trajectory of the British currency and the EUR/GBP pair.

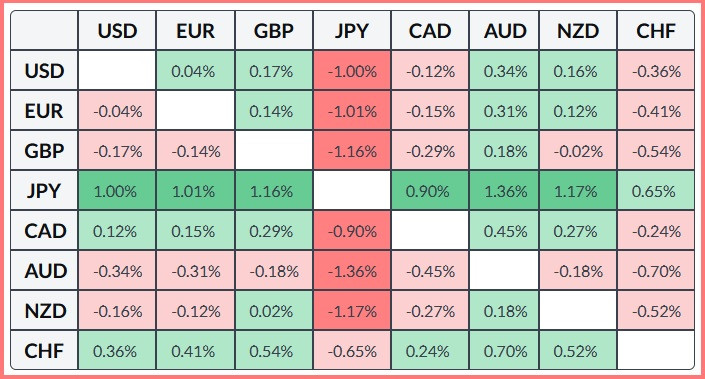

From a technical perspective, the pair is trading below the 100-day SMA, attempting to consolidate above the 50-day SMA, with oscillators on the daily chart showing mixed signals. All these components confirm a sideways situation. However, as the Relative Strength Index has moved into positive territory, bulls have gained strength to contend. If prices break above the 100-day SMA, bulls will gain control of the market. The table below shows the percentage change of the euro against major currencies today. The euro shows the most notable strength against the Australian dollar among the major currencies.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.