See also

30.07.2025 05:13 AM

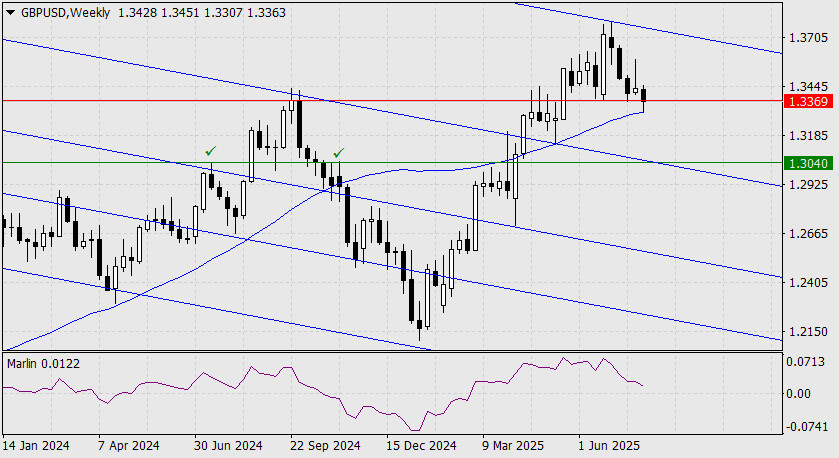

30.07.2025 05:13 AMBy the end of yesterday, the British pound had settled below the 1.3369 level. But let's take a look at the weekly chart — here, the price has tested support at the MACD line:

A drop below this line would open the way toward the 1.3040 target — the embedded line of the global price channel, coinciding with the resistance levels from July and November 2024 (checkmarks).

On the daily chart, the nearest target is support at 1.3265 — the peak from August 2024.

Reaching this support would automatically mean a break below the weekly MACD line. Intermediate levels on the way to the main 1.3040 target are marked on the chart: 1.3206, 1.3090. This is the main scenario.

Under the alternative scenario, a consolidation above 1.3369 would return the price into a zone of uncertainty, with the upper boundary at 1.3631.

On the four-hour chart, the price is showing signs of consolidation below the 1.3369 level. From above, the MACD line is approaching this level, reinforcing it and slightly increasing the likelihood of a downward move in connection with the FOMC meeting this evening.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.