See also

18.07.2025 01:38 PM

18.07.2025 01:38 PMToday, Friday, the USD/CAD pair is pulling back from a three-week high near 1.3775 recorded yesterday. At the moment, prices are trading slightly below the 1.3730 level, showing a modest daily decline of about 0.15%. This dynamic points to a lack of strong bearish conviction.

The overall backdrop for the US dollar remains moderately bullish despite comments from Federal Reserve Governor Christopher Waller supporting a rate cut in July. These dovish remarks have caused a slight pullback in the US dollar today.

Nevertheless, significant USD weakening is unlikely, as the Fed may maintain higher interest rates for longer due to persistent inflation concerns.

A key factor is geopolitical and trade uncertainty: Trump's announcement of a 35% tariff on imports from Canada starting August 1 — with a possible increase if Canada retaliates — is putting pressure on the Canadian dollar. Additionally, the introduction of 50% tariffs on US copper could further limit the loonie's upside, indirectly supporting the USD/CAD pair.

Oil prices continue to rise following a recent rebound. Commodity gains typically support the Canadian dollar, given its correlation with the resource sector. However, limited oil upside and trade-related risks may dampen this effect.

Today, better trading opportunities may come from closely monitoring US economic data: preliminary consumer sentiment and inflation expectations from the University of Michigan, along with housing market figures. Overall risk sentiment remains supportive for the US dollar, contributing to its moderate strength.

In general, USD/CAD has shown moderate gains for the second consecutive week, influenced by both domestic macroeconomic factors and geopolitical risks.

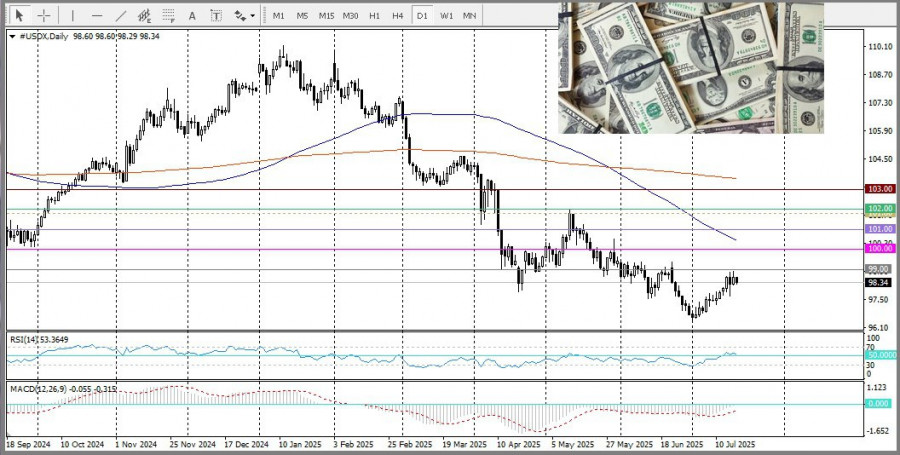

From a technical perspective, the Relative Strength Index remains in positive territory, confirming the bullish outlook. If the pair holds above the key 1.3700 level, there is a strong chance it will overcome the next resistance at 1.3760. A break above this would pave the way toward the psychological 1.3800 level, followed by the next barrier at 1.3861, with 1.3900 coming in as the subsequent round number target.

On the other hand, the 1.3700 level serves as immediate support, followed by 1.3678. A break below that level could weaken the pair significantly and lead to a deeper decline.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.