See also

22.04.2025 01:07 AM

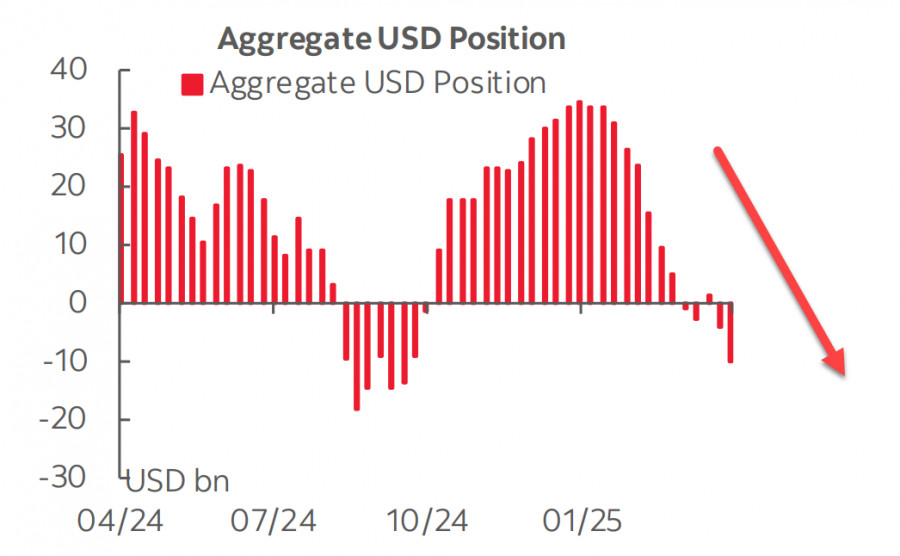

22.04.2025 01:07 AMThe total speculative bearish position on the US dollar more than doubled over the reporting week, reaching -$10.1 billion. The Canadian dollar and the yen strengthened the most, while the euro's movement was slightly weaker—but in any case, it must be acknowledged: the dollar remains under heavy pressure.

Gold sets records almost daily, exceeding $3,400 per ounce—which is clearly not the limit. Even oil has resumed its growth despite the apparent shift toward safe-haven assets. This indicates that investors no longer view the US dollar as a safe haven.

Monday's sell-off was, as usual, triggered by the US President. In a Truth Social post, Trump called Federal Reserve Chair Jerome Powell a "major failure" and demanded an immediate start to rate cuts. According to Trump, inflation in the US has been virtually defeated, and any delay in rate cuts will lead to an economic slowdown—something he is trying to avoid at all costs. He must present the US as a reliable and attractive economy in his tariff war to stimulate capital inflows.

Moreover, Trump is reportedly considering firing Powell (whom he appointed himself) before the end of his term. This has sparked a new wave of sell-offs in US equity markets. The Fed doesn't want to rush. It has its plan and is sending signals intended to calm panic. Goolsbee stated that "short-term inflation expectations have increased, so we need to wait to see what happens next." At the same time, the yield on 5-year inflation-protected Treasury bonds (TIPS) has sharply declined in the past week—indicating the opposite trend.

The swap market has again priced in the possibility of four Fed rate cuts this year. Consequently, the dollar is losing support. Trump's plan to introduce new tariffs has not yet worked—China is refusing to make concessions and has even warned other countries against making deals with the US at their own expense.

It is unclear who will emerge as the winner—if there will be a winner. However, investors are buying gold instead of dollars, just in case.

Last week, we predicted that it wouldn't signal a reversal even if the S&P 500 rallied. On the contrary, it would be short-lived, as fundamental reasons continue to push the index downward.

And so it happened: the S&P 500, after a brief consolidation, once again headed south. The sell-offs are beginning to resemble panic again, and the 4,800 level no longer seems unreachable. Moreover, the long-term target has shifted to the 4,500 level. If a pullback occurs, it will likely be shallow—there are virtually no reasons to expect a sustained rebound.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.