See also

08.04.2025 05:03 AM

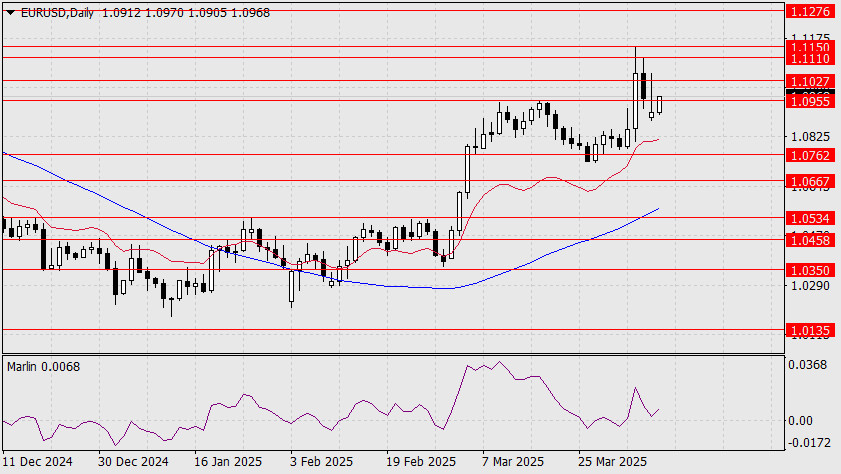

08.04.2025 05:03 AMOn Monday, the euro reached the 1.1027 target level but dropped below 1.0955. Nonetheless, the single currency achieved its primary goal, reaffirming its intent to resume growth. Currently, the price is attempting to rise above the 1.0955 resistance level. If successful, the move toward 1.1027 may continue with stronger support. The Marlin oscillator has turned upward without even reaching the boundary of the bearish territory.

The increasing distance between the price and the balance line (red moving average) is also worth noting, which suggests the past two days' price action was merely a correction within a medium-term upward trend. However, this growth may end relatively soon—around the 1.1276 level, the next target above the most recent high.

This growth is occurring against the backdrop of a rising stock market correction. Once that correction ends, the currency market may also reverse, shifting back to the US dollar as a safe-haven asset.

The balance line has supported the price on the four-hour chart throughout the two-day correction. The Marlin oscillator briefly entered bearish territory, but if it resumes upward movement, this can be considered a false signal—another sign of further growth.

The first target is 1.1027. A breakout above this level opens the way to the second target, 1.1110.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.