See also

22.09.2023 03:30 PM

22.09.2023 03:30 PMThe upcoming week is expected to be much calmer than the one ending. Significant macroeconomic data will only start appearing on Tuesday, with the release at the beginning of the U.S. trading session of the U.S. housing price indices (the housing market is an important part of the U.S. economy, and housing prices are interconnected with the inflation rate) and the U.S. consumer confidence index (survey respondents assess the current and future economic conditions and the overall economic situation in the U.S.).

The dollar maintains a positive trend, holding its positions after the FOMC meeting concluded last Wednesday. However, it is declining against major commodity currencies, such as the New Zealand dollar, the Australian dollar, and especially the Canadian dollar, which is receiving support from the rise in energy prices, primarily oil.

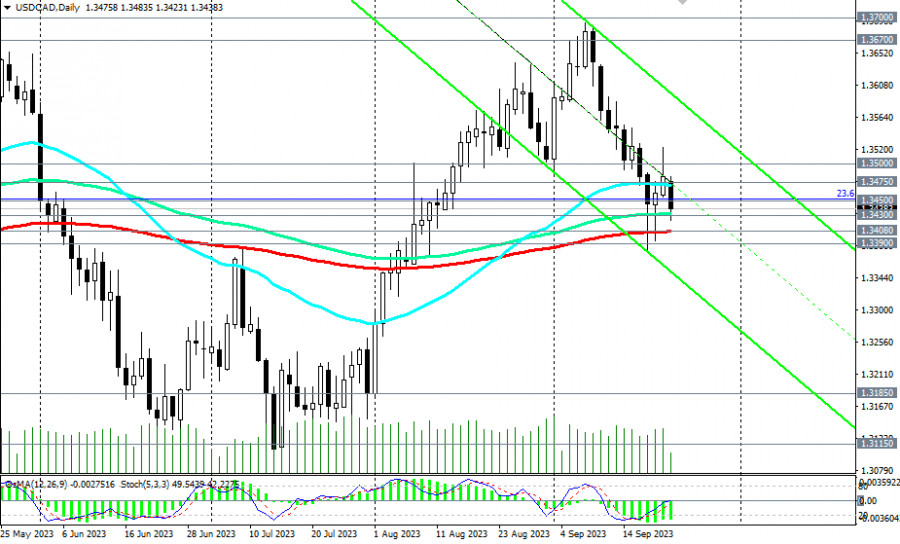

Thus, the USD/CAD pair is declining today, testing the crucial medium-term support level of 1.3430 (144 EMA on the daily chart).

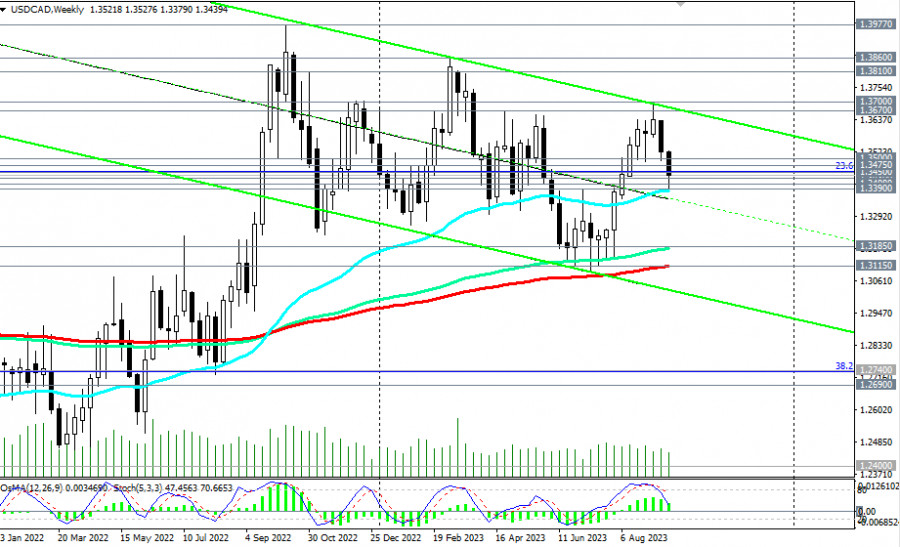

Further decline and a break below key supports at 1.3408 (200 EMA on the daily chart), 1.3390 (50 EMA on the weekly chart) will lead USD/CAD into the zone of the medium-term bearish market, and a break of support levels at 1.3185 (144 EMA on the weekly chart) and 1.3115 (200 EMA on the weekly chart) will bring it into the long-term bearish zone, once again making short positions preferable.

However, we still adhere to our main scenario and expect a rebound near the support level of 1.3430, which has happened. As of writing, the price turned around and started moving up.

A rise above the important resistance level of 1.3450 (50 EMA on the daily chart and the 23.6% Fibonacci level of the correction wave from 0.9700 to 1.4600, reached in June 2016) and a break of the crucial short-term resistance level of 1.3500 (200 EMA on the 1-hour chart) will confirm the resumption of the upward dynamics of the pair.

Support levels: 1.3430, 1.3408, 1.3390, 1.3320, 1.3300, 1.3200, 1.3180, 1.3115

Resistance levels: 1.3450, 1.3475, 1.3500, 1.3600, 1.3670, 1.3700, 1.3810, 1.3860, 1.3900, 1.3970, 1.4000

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.