See also

22.09.2023 04:45 PM

22.09.2023 04:45 PMWhen central banks are in the final stages of tightening their monetary policies, their main task is to prevent the markets from betting on a dovish pivot. The Federal Reserve achieved this with the help of FOMC forecasts. However, the European Central Bank (ECB) did not. The ECB has shown that it is satisfied with the deposit rate at 4%, and bulls on the EUR/USD were immediately punished for it. The Fed conducted its meeting much more effectively.

Divergence in monetary policy is a key driver of the major currency pair's peak. Investors are almost certain that the ECB's monetary tightening cycle is over. With the Fed, things are not so straightforward. The Fed can still raise borrowing costs, but more importantly, it intends to keep them at 5.5% for an extended period. The September FOMC forecasts imply only one cut in the federal funds rate in 2024, down to 5.25%, which is higher than market estimates.

Dynamics of Fed and market forecasts on the federal funds rate

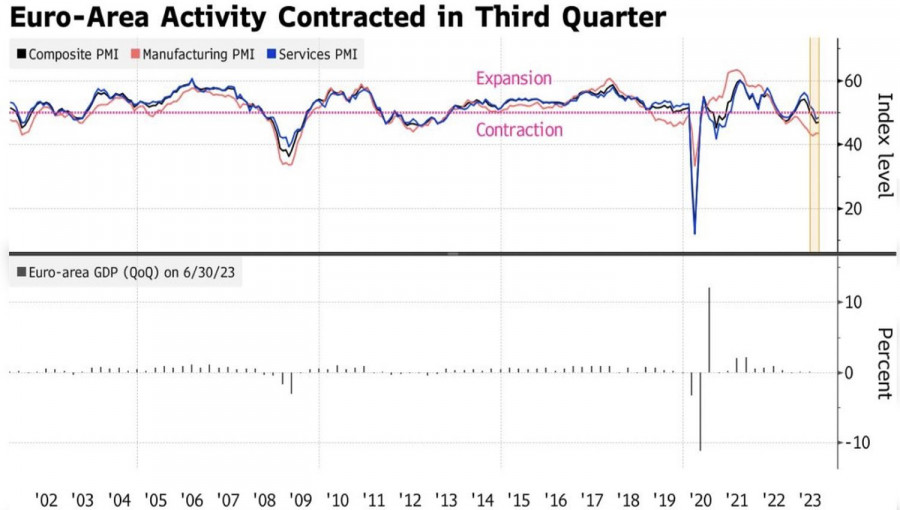

The basis for the decline in EUR/USD lies in the divergence in economic growth. If U.S. GDP can expand by 3% or more in the third quarter, the latest European business activity statistics indicate weakness in the currency bloc. The composite Purchasing Managers' Index (PMI) in September, while exceeding the Bloomberg consensus forecast of 46.6 by coming in at 47.1, remains in the zone below 50. This signals a contraction in the eurozone economy from July to September, albeit by only 0.1%.

This is bad news for the euro, as the ECB does not foresee a recession. It believes that the currency bloc will remain in a state of stagflation for a long time, but it will avoid a decline. If gross domestic product still contracts, this will be another blow to EUR/USD. However, judging by the reaction of the major currency pair to PMI data, there is already so much negativity priced in that you begin to get used to it. After hitting five-month lows, the euro has strengthened slightly against the U.S. dollar.

Dynamics of European business activity

Thus, divergences in monetary policy and economic growth continue to favor the bears on EUR/USD. For a correction in the pair, a deterioration in macroeconomic statistics from the United States is needed. This could occur if Republicans in Congress get their way and temporarily halt government operations. According to Credit Agricole, faith in a quick resolution of the problem will strengthen the position of the U.S. dollar. Conversely, if investors believe the conflict is long-lasting, the risks of an economic slowdown will weigh on the bears on EUR/USD.

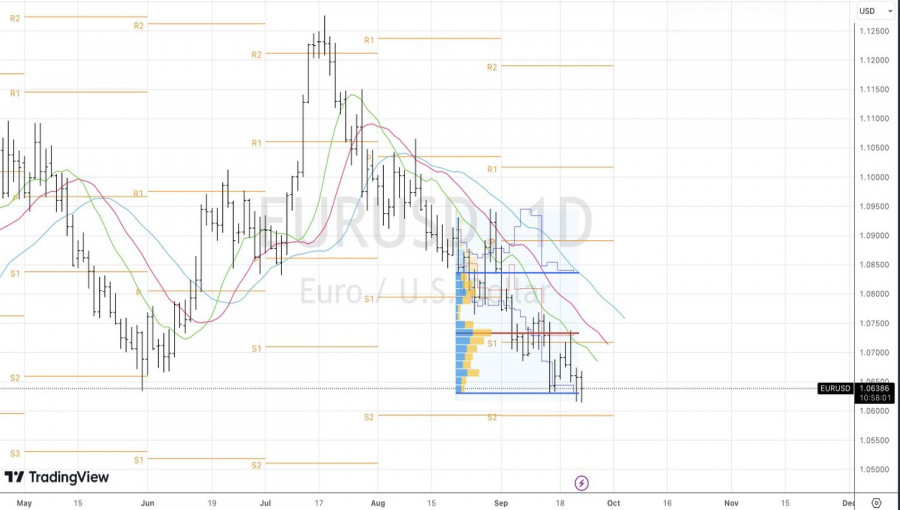

Technically, on the daily chart of the EUR/USD pair, the bulls are not giving up hopes of playing a pin bar. To activate it, a return of EUR/USD above 1.067 is required. In this case, it makes sense to form long positions. Conversely, the inability of buyers to hold quotes above 1.063 will allow us to increase shorts formed in the range of 1.0715–1.0730.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.