یہ بھی دیکھیں

11.02.2026 08:41 AM

11.02.2026 08:41 AMThe price of gold could rise to $6000 per ounce by the end of the year, and the gold-to-silver ratio is expected to increase as macroeconomic and geopolitical risks persist.

According to a report by BNP Paribas SA, the gold-to-silver ratio, while still below its two-year average level of around 80%, may widen significantly. "We believe that the gap between the prices may increase. In our view, silver does not provide the same degree of risk protection as gold."

The outlook for the gold market appears quite optimistic, largely driven by two key factors: sustained interest from central banks and continued inflows of capital into gold exchange-traded funds (ETFs). Ongoing purchases by central banks, especially in light of Poland's unexpected announcement last month of acquiring an additional 150 tons of the precious metal, after becoming the largest buyer the previous year, reflect a strategic shift in reserve policies among many countries. This move highlights the desire to diversify reserves and hedge against risks associated with volatility in other assets.

Alongside institutional purchases, gold ETFs are showing steady inflows. Despite the brief dip experienced during the recent market correction, the overall trend remains positive. This indicates that, despite short-term fluctuations, investors maintain faith in gold's long-term growth potential. Demand from retail and smaller institutional investors using ETFs to access gold complements the actions of central banks, creating a strong foundation to support prices.

This combination of sustained demand from major players and ongoing interest from a broad range of investors provides a favorable backdrop for further increases in gold's value towards $6000 per ounce.

Many banks and asset managers, including Deutsche Bank AG and Goldman Sachs Group Inc., also believe that gold will recover thanks to these long-term demand factors. Highlighting consistent official demand, the People's Bank of China also extended its gold purchasing program for the 15th month in January.

Meanwhile, silver has shown extreme volatility in recent months due to active physical purchases, especially in Asia. However, signs of weakening are now evident in the physical market, as metal supplies are arriving in Europe and Asia.

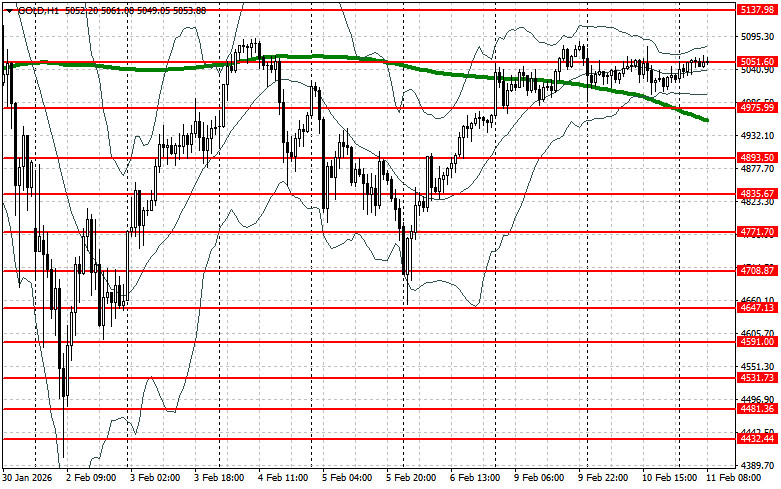

Regarding the current technical picture for gold, buyers need to reclaim the nearest resistance at $5051. This will allow them to target $5137, above which it will be quite challenging to break through. The furthest target will be around $5223. In the event of a decline in gold, bears will attempt to take control over $4975. If they succeed, breaking this range will deal a serious blow to bullish positions and push gold down to a low of $4893, with the prospect of reaching $4835.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.