یہ بھی دیکھیں

05.02.2026 09:05 AM

05.02.2026 09:05 AMYesterday, equity indices closed lower. The S&P 500 fell by 0.51%, while the Nasdaq 100 plunged by 1.51%. The Dow Jones Industrial Average, however, rose by 0.53%.

The sell-off in software and technology stocks spread rapidly to Asia as growing concern about inflated valuations and massive AI investments prompted investors to cut positions.

Many link this to a global correction caused by an overheated tech sector and increasing regulatory scrutiny of AI companies. Investor anxiety is compounded by doubts over companies' ability to justify high AI-related expectations. Despite enormous investment, meaningful results and monetisation of many projects remain uncertain. That is forcing investors to re-assess risk and rotate into more conservative assets.

The MSCI index tracking Asian tech stocks fell for the fifth time in six sessions on Thursday, with laggards, including Samsung Electronics Co. and SoftBank Group Corp. South Korea's Kospi, a prime example of AI-linked investment and the best-performing index this year, led the decline, down 3.5%. Sentiment worsened further after Alphabet Inc., Qualcomm Inc., and Arm Holdings Plc fell in after-hours trading following weak results. Futures on US equity indices also dropped.

Outside the tech sector, attention focused on precious metals. Silver plunged by 17%, and gold lost 3.5% as these commodities continue to show high volatility after the historic market rout. Against a weak risk backdrop, Bitcoin continued to slide and briefly approached the $70,000 mark.

Although AI-driven sell-offs have occurred before, nothing compares to the crash that swept equity and credit markets this week. With the US economy still showing resilience, investors are reallocating to other sectors, which explains the divergence between the Nasdaq (down 1.5%) and the Dow (up 0.51%).

Over two days, stocks, bonds, and Silicon Valley credit lost hundreds of billions of dollars. At the epicentre were software developers: the market value tracked by iShares software ETFs has fallen by nearly $1 trillion over the past seven days.

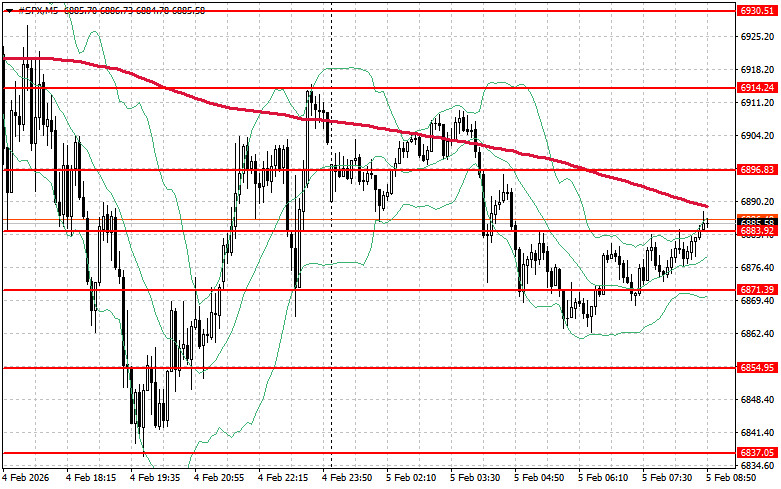

As for the technical outlook for the S&P 500, the immediate task for buyers today is to overcome the nearest resistance level of $6,896. Breaking above that level would indicate upside and open the path to $6,914. An additional priority for bulls is to secure control above $6,930, which would strengthen buyers' positions. In case of a downside move amid waning risk appetite, buyers must assert themselves around $6,883. A break below that level could quickly push the instrument back to $6,871 and open the way to $6,854.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.