Vea también

05.12.2025 02:29 PM

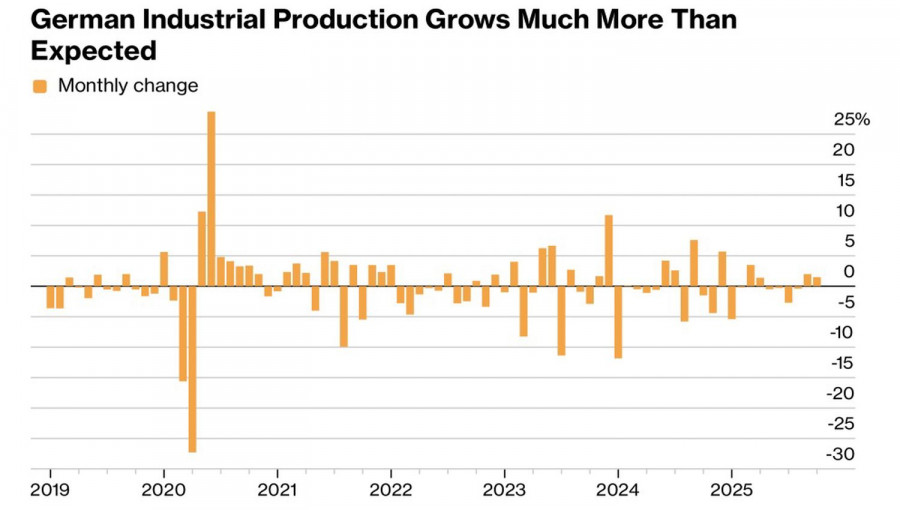

05.12.2025 02:29 PMThe main reason cited for the rally in EUR/USD is the increased likelihood of a 25-basis-point rate cut to 3.75% in December, rising from less than 30% at the end of November to nearly 90% now. However, the euro is not a lightweight. The European Central Bank has succeeded in combating inflation without pressure, unlike the Federal Reserve. Business activity in the Eurozone has surged to its highest level in 2.5 years, and the growth in German manufacturing orders suggests that Germany's GDP will impress in the fourth quarter.

According to Bank of America, EUR/USD is expected to rise to 1.22 by the end of 2026, driven by a low bar for reforms, convergence in economic growth, and currency market hedging. I would add to these "bullish" drivers the capital flow from the United States to Europe.

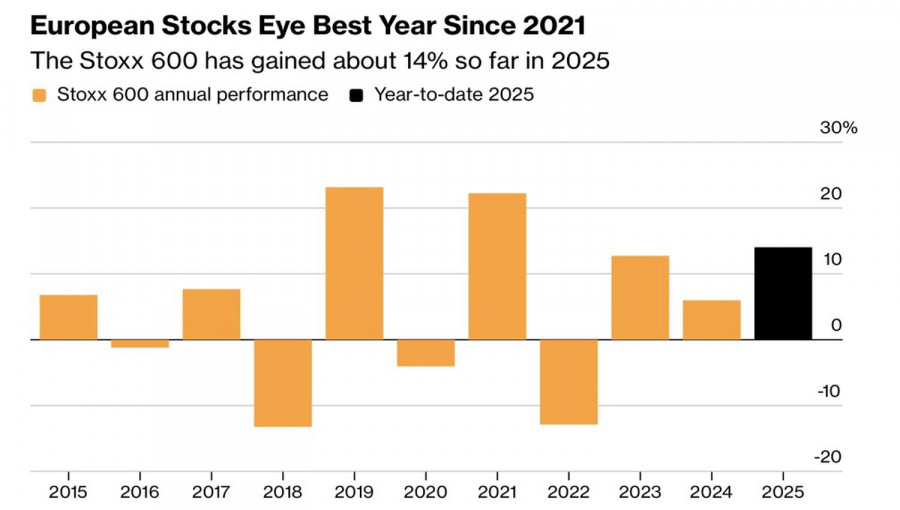

Fiscal incentives from Friedrich Merz contributed to a 12% rally in EUR/USD in 2025. However, discussions arose towards the year's end that these measures were insufficient. Germany needs reforms, and its government is capable of implementing them. The implementation of these programs will add fuel to the upward movement of the euro, as will the narrowing gap in GDP growth between the US and the Eurozone, known as convergence. Negative impacts from tariffs and the delayed effects of the government shutdown risk slowing the US economy.

Regarding hedging, there can be a debate with Bank of America. Insurance against the depreciation of the US dollar for non-resident investments in US-issued assets was popular in 2025 amid record capital inflows to the US. However, much could change in 2026.

This year, European stock indices have outperformed their American counterparts, partly due to the strengthening euro. Their fundamental valuations, including P/E ratios, are low compared to those of the same technology companies, and a gradual loss of interest in artificial intelligence will reduce the attractiveness of US stocks. In this case, hedging may not be required, as there will be capital flowing from North America to Europe.

If we add the divergence in monetary policy between the Fed and the ECB to this, the medium-term prospects for EUR/USD appear significantly bullish. That said, anything can happen in the short-term investment horizon. No trend is without corrections. A catalyst for a pullback could be Jerome Powell's hawkish rhetoric at the press conference following the December FOMC meeting.

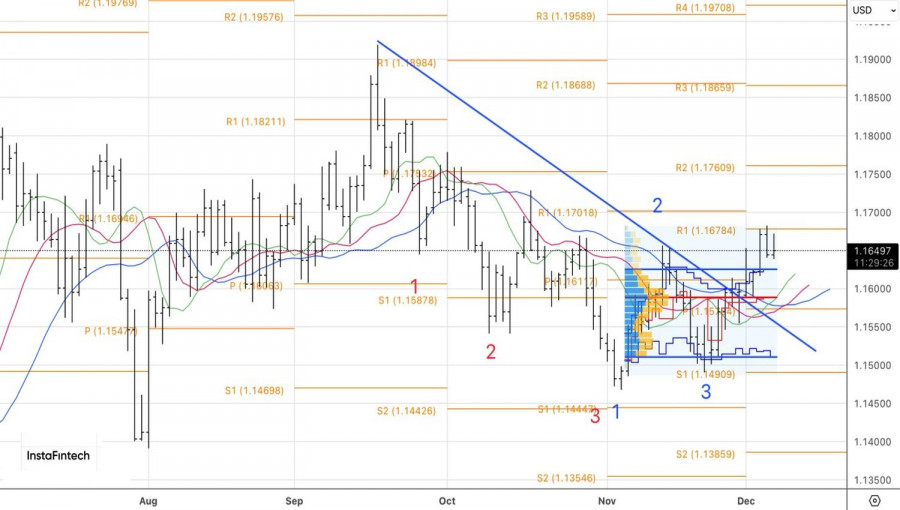

Technically, on the daily chart, EUR/USD is forming a 20-80 pattern. The bulls' inability to break above 1.1675 is a testament to their weakness and has increased the risk of consolidation. At the same time, a rebound from the upper boundary of the fair value range at 1.1625, or from the pivot level at 1.1585, may provide a basis for buying euros against the US dollar.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.