Vea también

21.01.2026 12:32 AM

21.01.2026 12:32 AMOn Tuesday, the AUD/JPY pair confidently continued the prior day's rebound from the 105.20 level, the weekly low, showing steady gains for a second day in a row. In the first half of the European session, the momentum pushed spot quotes to 106.82 — the highest level since July 2024 — supported by a combination of factors.

The Japanese yen is under strong selling pressure amid concerns about a deterioration in Japan's fiscal position due to Prime Minister Sanae Takaichi's spending plans, which acts as a supporting factor for AUD/JPY's rise.

On Monday, Takaichi confirmed her intention to dissolve parliament this week and hold early general elections on February 8 to strengthen the mandate for an ambitious spending policy.

In addition, weak demand at the 20-year JGB auction triggered a sell-off in government bonds overall, lifting yields on 40-year Japanese government bonds to record levels and adding pressure on the national currency.

Meanwhile, the Australian dollar is strengthening thanks to continued US dollar selling and the RBA's hawkish rhetoric, which further fuels AUD/JPY's advance.

However, it is unclear whether AUD/JPY bulls can maintain control or will take profits amid the risk of Japanese authorities intervening to curb further yen weakness.

Last Friday, Japan's Finance Minister Satsuki Katayama indicated that direct intervention remains among the possible measures to address the recent currency weakness. Therefore, exercise caution ahead of the key Bank of Japan meeting on Friday, at which the central bank is expected to keep rates unchanged after the recent rise of the overnight lending rate to 0.75% — a 30-year high. Comments by BOJ Governor Kazuo Ueda at the post-decision press conference will provide guidance on the timing of the next rate hike and could give the yen fresh impetus, affecting AUD/JPY dynamics.

From a technical perspective, the pair has shown resilience below the round 106.00 level, with resistance at 106.80. Since daily-chart oscillators are positive, the path of least resistance for the pair is upward. However, note that the relative strength index is close to the overbought zone, which suggests a degree of consolidation for the pair.

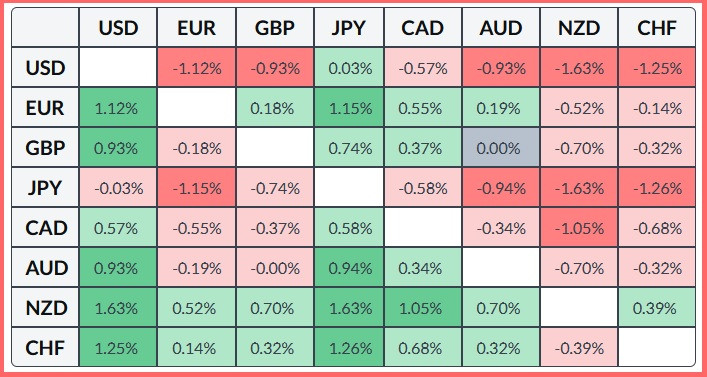

The table below shows the percentage change in the Japanese yen against major currencies this week, with the yen weakest against the US dollar.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.