Vea también

29.12.2025 09:42 AM

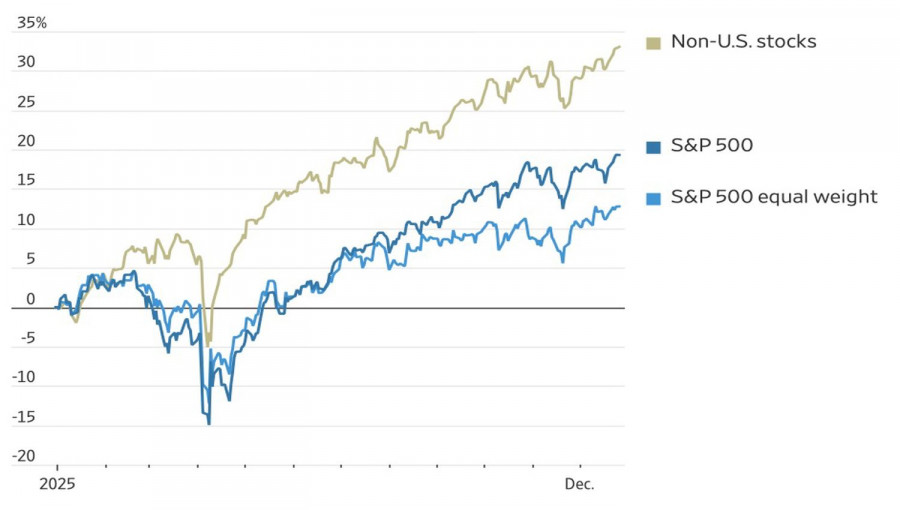

29.12.2025 09:42 AMSometimes, doing nothing is better than doing something. The "buy and hold" strategy often yields better results than constantly revising an investment portfolio. This is evidenced by the outgoing year. Despite all the upheavals, holding stocks purchased at the start of January turned out to be an effective strategy. If foreign company stocks had been acquired, the returns would have been even higher. Overall, the S&P 500's 18% rise is a considerable success for passive investors.

Dynamics of Stock Indices

Major upheavals in 2025 included the White House tariffs, the resulting loss of confidence in American assets, and finally, doubts about artificial intelligence technologies. Import tariffs proved to be more extensive and damaging to the stock market than previously anticipated. The S&P 500 saw a significant drop in April. However, once the "TACO" strategy (Trump Always Chooses Out) was fully operational, bulls became unstoppable.

Indeed, the understanding that higher tariffs would no longer be imposed allowed investors to buy up almost every dip in the S&P 500. Pessimists believed that the highest import tariffs since the 1930s would undermine confidence in American assets and facilitate capital outflows from the US stock market. This did not happen. The US market remains the largest and most liquid in the world. The return of non-residents has been more than successful. Since reaching the April low, the S&P 500 has increased by 43%.

In the fall, doubts surfaced regarding the effectiveness of investing in artificial intelligence technologies. Massive investments failed to generate the level of returns that traders had anticipated. Additionally, rumors of a pause in the monetary expansion cycle began to circulate, depriving the S&P 500 of its safety cushion.

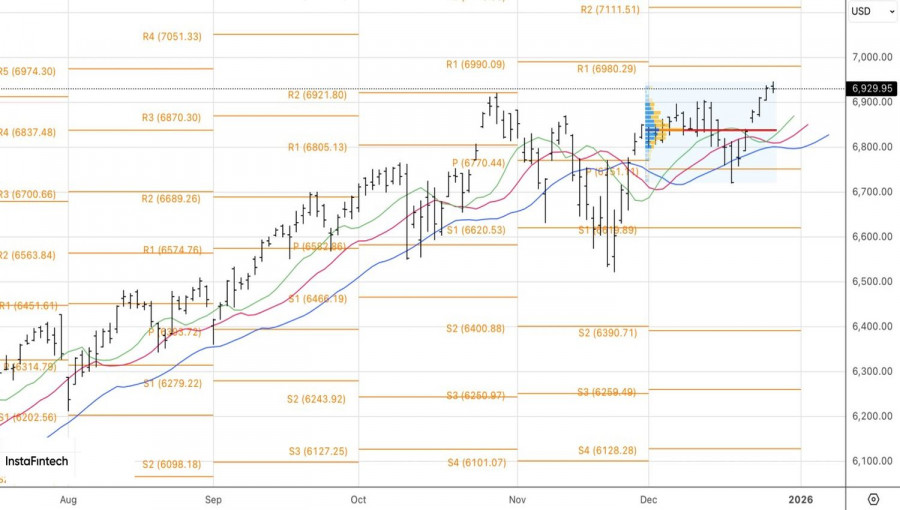

Weekly S&P 500 Dynamics

The pullback was not as deep as expected. The market quickly recovered, stabilized, and set records as the year closed. Consequently, the last full week of December proved to be the best for the S&P 500 in almost a month.

Investors are optimistic about the future. Bloomberg experts expect US economic growth of 2% in 2026, which will support corporate profits and help the S&P 500 extend its rally. This aligns with expectations for the continuation of the Federal Reserve's monetary expansion cycle, with a 51% chance of an interest rate cut in March.

Moreover, the new Fed chair is likely to do everything possible to expedite the easing of monetary policy. Donald Trump has no need for another central bank head.

From a technical standpoint, the daily chart of the S&P 500 shows that the upward trend is gaining momentum. The broad market index is moving away from dynamic support levels in the form of moving averages, indicating the strength of bulls. It makes sense to maintain a focus on buying, targeting the levels of 7,000 and 7,100.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.