Lihat juga

04.04.2025 05:34 AM

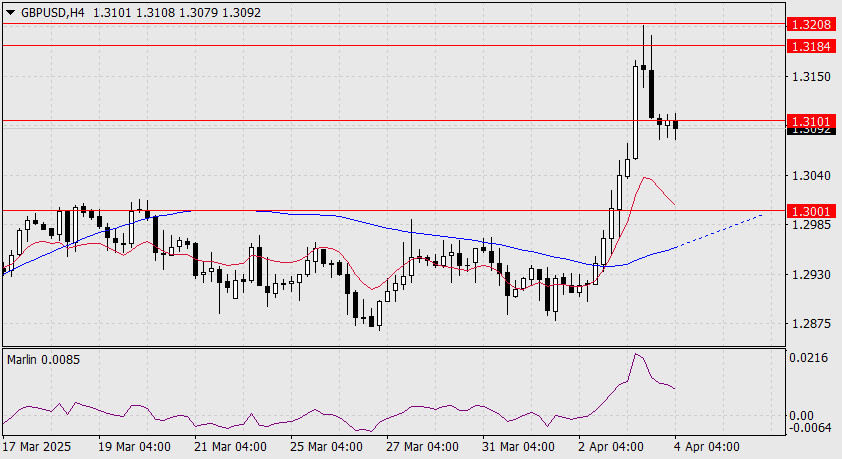

04.04.2025 05:34 AMBy the end of yesterday, the British pound had risen by 92 pips, with a peak gain of 204 pips. The price reached the target range of 1.3184–1.3208 before retreating to the support level 1.3101. This is a convenient area to await today's U.S. employment data, as it sits near the midpoint of the 1.3001–1.3208 range.

The forecast for new nonfarm jobs in March is 137,000, down from 151,000 in February. Unemployment is expected to remain unchanged at 4.1%.

If the data comes close to forecasts, the pound could decline due to the relative speed at which U.S. bond yields are falling compared to those in the UK. U.S. 5-year Treasury yields are at 3.40%, while their UK counterparts yield 4.10%.

The nearest downside target for the pound is 1.3001. Additionally, the Marlin oscillator is rising much more slowly than March 3–6, signaling a possible transition to either consolidation or a reversal. A break below 1.3001 would push the oscillator into negative territory, opening the way to the target range of 1.2816–1.2847.

On the H4 chart, the price is beginning to consolidate below the 1.3101 level. Marlin is declining, indicating a bearish bias. A drop below 1.3001 would also signify a break of the MACD line. As of this morning, the outlook is bearish. We await the release of U.S. employment data. Weak figures followed by price growth could lead the pound toward the target level of 1.3311.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.